If you want to claim tax relief on employment expenses via a form P87, you will now need to provide your Employer’s PAYE reference number. Some employees may not know this number and may not be able to find it easily as it is not always included on payslips. Here we tell you some different places to try.

You can use form P87 to make a claim for tax relief in certain circumstances:

From 21 December 2022, claims for tax relief made on P87 forms must include the following information:

HMRC say that any forms that do not include the required information, received on or after 21 December 2022, will be rejected.

You can find some general guidance on completing the form, including an annotated version of the form, in our website guidance. If you can’t find your employer PAYE reference number, then read on!

A PAYE reference number (or Employer Reference Number) consists of a unique set of letters and numbers used by HMRC to identify your employer and their Pay As You Earn (PAYE) scheme.

The reference is in two parts. The first part is made up of three digits and tells HMRC which tax office looks after that particular employer. The second part can be a combination of letters and/or numbers which will identify the employer that the reference belongs to. A typical reference may look something like this 123/AA6543.

As the PAYE reference number identifies the employer, not the employee, if you work for more than one employer, you will have more than one PAYE reference number.

You may be able to find the number on payroll correspondence from your employer. Although it is not a legal requirement for employers to include it on a payslip, some employers do include it.

It can also be found on a P60 or P45, although this won’t help you if you have not been with your employer long enough to get a P60 or do not have a P45!

If you still can’t find it, you may be able to find it in your Personal Tax Account (PTA).

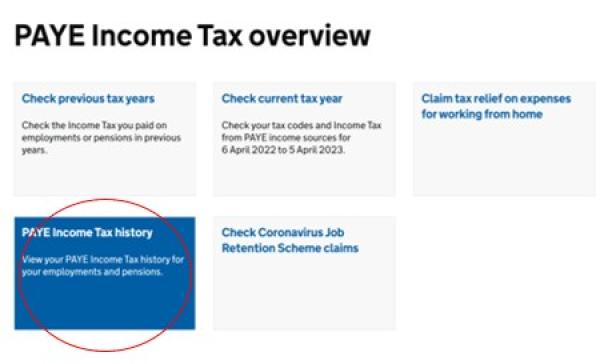

From the home page of your PTA, select the tile called Pay As You Earn (PAYE).

Your Employer PAYE reference number is available in a number of different places, but probably the easiest place is PAYE Income Tax history.

If you do not already have a PTA set up, you will need to get some Government Gateway sign in credentials. You are asked for an email address, a mobile phone number and some personal details, e.g. name, date of birth and National Instance number (you can provide your postcode if you don’t have a National Insurance number).

You will then have to answer some further questions to help HMRC identify you – you are given the option of answering questions on:

If you select ‘payslips’ for example, you may be asked ‘How much National Insurance is shown in the ‘Deductions’ section on one of your recent payslips?’. You need to answer two such questions and, provided you answer them satisfactorily, you will proceed onto the home page of PTA.

If all else fails, you could try asking your employer to confirm their PAYE reference number.

Please let us know as we are interested to understand how HMRC’s update to the form might be impacting on taxpayers.

If you want to make a claim for tax relief, even though you cannot complete form P87 because you don’t have your employer PAYE reference, it may be possible to claim tax relief by calling HMRC instead. This will usually only apply where you’ve already claimed the same type of expense in a previous year.

If you do not have your employer PAYE reference, you will probably not be able to use a tax refund company to help you make a claim for tax relief. They have to use the form P87 and have no other options available to them.